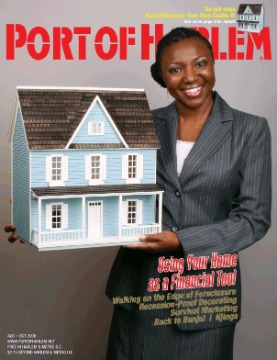

COVER STORY

COVER CREDITS

Personal mortgage consultant, Donna Smith, simplifies the choices of mortgage products that are available to help

you build or renovate your castle. Meet her at POH’s Build/Renovate Your Own Castle III.

Photo by Camille Mosley-Pasley of Pasley Place Photography.

Makeup by Kawana. Doll house from Once Upon a Time. Jewelry by Anthony Driver.

20 Using Your House As a Financial Tool: Mortgage Strategies

Building or renovating your house into your dream castle requires the right tools, which include the right financial products. In the cover story, personal mortgage consultant Donna Smith discusses the different types of mortgages, and how you can use your home as a financial tool to reach your homeownership and other dreams.

FOCUS: Build/Renovate Your Own Castle III

23 In Your Castle

FEATURE:

24 Poetry Pier

DEPARTMENTS

2 LETTERS TO THE EDITOR

THE PUBLISHER’S POINT

4 You Are Invited

PRAISING THE PAST

5 Njinga

Using Your Home As a Financial Tool:

Mortgage Strategies

On The Dock

THE OTHER SIDE

6 Where Hope Still Lives

THE MIDDLE PASSAGE: A STORY OF SURVIVAL

7 Walking Along the Edge of Foreclosure

MONEY MATTERS

8 Survival Marketing for Today’s Economy OUR SPACE

10 Recession-Proof Decorating

TRAVEL STORY

12 Back to Banjul

HEALTH

14 Interactions of the Wrong Kind

16 Thriving with Lupus

RECIPE

25 Café Trope’s Tuna Tartar

BOOK REVIEW

26 Bent Knees

Straighten Crooked

COMING UP

27 Harlem Week Marketplace, Democratic, and Republican Conventions

ENTERTAINMENT

28 The 45s’ Comeback

6 Where Hope Still Lives

THE MIDDLE PASSAGE: A STORY OF SURVIVAL

7 Walking Along the Edge of Foreclosure

MONEY MATTERS

8 Survival Marketing for Today’s Economy OUR SPACE

10 Recession-Proof Decorating

TRAVEL STORY

12 Back to Banjul

HEALTH

14 Interactions of the Wrong Kind

16 Thriving with Lupus

RECIPE

25 Café Trope’s Tuna Tartar

BOOK REVIEW

26 Bent Knees

Straighten Crooked

COMING UP

27 Harlem Week Marketplace, Democratic, and Republican Conventions

ENTERTAINMENT

28 The 45s’ Comeback

;

;

Using Your Home as a Financial Tool

;

Building or renovating your house into your dream castle requires the right tools, which include the right financial products. In this article, we will discuss the different types of mortgages, and how you can use your home as a financial tool to reach homeownership and your other dreams.

A mortgage is a loan that you use to finance the purchase of real estate (property); and that you can use to obtain equity, which is the difference between what your property is worth and the balance of what you owe. In other words, equity equals the ‘cash’ in your home.

Let us explore a few scenarios to highlight how the right mortgage can help you to realize your dreams and maximize your equity.

Traditional 30 Year Fixed Rate Mortgages (FRM)

WHO: The buyer who does not like to take risks.

HOW IT WORKS: Interest rates and monthly payments remain fixed for a period of time or term of the loan. FRMs are commonly available for 15, 20, 30, and 40 year terms. Typically, the shorter the term, the higher the monthly payments.

WHEN: This product is typical when the property involved is the second or third home, or “dream” home, and is considered the last major mortgage investment.

THE POSITIVE: Security. The interest rate never changes.

THE NEGATIVE: High monthly payments and high interest rates.

Adjustable Rate Mortgages (ARM)

WHO: The buyer who is willing to take more risks than those who choose FRMs.

HOW IT WORKS: Rates and respective monthly payments are fixed for a period of time, then adjust (change) according to the economic market. The most common ARMs are 5 and 7 year terms.

WHEN: ARMs are recommended for homebuyers and investors who want

low interest rates and low monthly payments.

THE POSITIVE: Attractive to buyers who want to use the money saved from not having a FRM to assist with other financial goals.

THE NEGATIVE: ARM rates adjust after the specific term. Monthly payments will increase or decrease according to the economic market. There are some risks involved, since it is hard to predict what will happen financially in the future.

Payment Option ARMs

WHO: Business owners, salespersons, artists, and others who earn money through commissions.

HOW IT WORKS: This product does not require a fixed monthly payment and allows the owner to choose from four payment options which include a minimum set by the lender, interest-only, 30-year principle and interest (P&I) or 15-year P&I.

WHEN: This product is recommended for a savvy buyer whose monthly income fluctuates and who can afford to pay more than just the minimum.

THE POSITIVE: When your income is down one month you can choose a lower monthly payment and protect your credit rating; and when your income increases you can make your regular P&I payments (or more).

THE NEGATIVE: If you only make the minimum payments, you will end up owing more than you originally borrowed.

Interest Only Mortgages (I/O)

WHO: People who are willing to take some risks and believe they will earn more in the future.

HOW IT WORKS: Monthly payments are based on the interest portion only for a setperiod of time. For example, a 30-year FRM with 10 year I/O means the loan will have a fixed rate for 30 years and interest only payments for the first 10 years. After the initial 10 years, the loan is then re-amortized (re-calculated) over the remaining 20 years (at the same fixed rate) resulting in higher payments for the last 20 years.

WHEN: I/O mortgages are typical for those who want to own more house at lower payments. My aunt would say these buyers want to “drink champagne on a beer budget!”

THE POSITIVE: Lower monthly payments and having the principle payment amount to use for other investing.

A mortgage is a loan that you use to finance the purchase of real estate (property); and that you can use to obtain equity, which is the difference between what your property is worth and the balance of what you owe. In other words, equity equals the ‘cash’ in your home.

Let us explore a few scenarios to highlight how the right mortgage can help you to realize your dreams and maximize your equity.

Traditional 30 Year Fixed Rate Mortgages (FRM)

WHO: The buyer who does not like to take risks.

HOW IT WORKS: Interest rates and monthly payments remain fixed for a period of time or term of the loan. FRMs are commonly available for 15, 20, 30, and 40 year terms. Typically, the shorter the term, the higher the monthly payments.

WHEN: This product is typical when the property involved is the second or third home, or “dream” home, and is considered the last major mortgage investment.

THE POSITIVE: Security. The interest rate never changes.

THE NEGATIVE: High monthly payments and high interest rates.

Adjustable Rate Mortgages (ARM)

WHO: The buyer who is willing to take more risks than those who choose FRMs.

HOW IT WORKS: Rates and respective monthly payments are fixed for a period of time, then adjust (change) according to the economic market. The most common ARMs are 5 and 7 year terms.

WHEN: ARMs are recommended for homebuyers and investors who want

low interest rates and low monthly payments.

THE POSITIVE: Attractive to buyers who want to use the money saved from not having a FRM to assist with other financial goals.

THE NEGATIVE: ARM rates adjust after the specific term. Monthly payments will increase or decrease according to the economic market. There are some risks involved, since it is hard to predict what will happen financially in the future.

Payment Option ARMs

WHO: Business owners, salespersons, artists, and others who earn money through commissions.

HOW IT WORKS: This product does not require a fixed monthly payment and allows the owner to choose from four payment options which include a minimum set by the lender, interest-only, 30-year principle and interest (P&I) or 15-year P&I.

WHEN: This product is recommended for a savvy buyer whose monthly income fluctuates and who can afford to pay more than just the minimum.

THE POSITIVE: When your income is down one month you can choose a lower monthly payment and protect your credit rating; and when your income increases you can make your regular P&I payments (or more).

THE NEGATIVE: If you only make the minimum payments, you will end up owing more than you originally borrowed.

Interest Only Mortgages (I/O)

WHO: People who are willing to take some risks and believe they will earn more in the future.

HOW IT WORKS: Monthly payments are based on the interest portion only for a setperiod of time. For example, a 30-year FRM with 10 year I/O means the loan will have a fixed rate for 30 years and interest only payments for the first 10 years. After the initial 10 years, the loan is then re-amortized (re-calculated) over the remaining 20 years (at the same fixed rate) resulting in higher payments for the last 20 years.

WHEN: I/O mortgages are typical for those who want to own more house at lower payments. My aunt would say these buyers want to “drink champagne on a beer budget!”

THE POSITIVE: Lower monthly payments and having the principle payment amount to use for other investing.

THE NEGATIVE: Your mortgage never decreases and you can end up with the same

balance as you started with after years of making payments.

Federal Housing Administration Mortgages (FHA)

WHO: First-Time Homebuyers and Low-to-Moderate Income Earners (Persons earning less than 30% of an area’s median income)

HOW IT WORKS: The Federal Government insures FHA loans so buyers with impaired credit or less cash can comfortably own their homes.

WHEN: FHA mortgages are good if you have only 3 percent of the home value for a down payment. FHA also has a rehabilitation mortgage that will allow you to find a fixer-upper and renovate it. THE POSITIVE: You do not have to have perfect credit, and can still qualify for a great interest rate.

THE NEGATIVE: In addition to paying the principal and interest, you also have to pay mortgage insurance that protects the lender against default, which can cause your monthly payments to be higher than if you chose another mortgage product.

Many people are aware of the benefits of financial products like their 401k, IRA, annuity, and stocks, but do not realize that they can also “cash” in on their home using products like the following:

Reverse Mortgages

WHO: Seniors 62 years and older

HOW IT WORKS: You can receive monthly cash payments from your existing home equity.

WHEN: Additional monthly income is desired to help pay for prescriptions and higher than expected retirement costs.

THE POSITIVE: You can reap the benefit of having loads of equity (cash) that you can use to supplement your income. As long as you live in the home, you do not have to pay the money back!

THE NEGATIVE: Interest is added to the loan balance because no payments are being made.

Home Equity Lines of Credit (HELOCs)

WHO: Homeowners with tons of equity!

HOW IT WORKS: HELOCs are second mortgages designed to use some of your equity as a line of credit.

WHEN: This mortgage is ideal for homeowners who have a great rate on

their first mortgage and want extra cash.

THE POSITIVE: You can receive a check book or credit card to draw on your line of credit. The interest on the amount used becomes your monthly payment.

THE NEGATIVE: You have two mortgage payments, and the rate on the HELOC can be significantly higher.

Even though the mortgage industry and the economy have endured some hard hits lately, the reality is that lenders are still lending, people are still buying and your dream castle is still waiting to be built or renovated. “For many home buyers, owning a home means a simple chance to own where they live,” says Ivan K. Brown, president of the Washington Real Estate Broker’s Association (WREBA), the historically-Black association of real estate professionals. “In reality, it will most likely prove to be their best investment tool,” he added.

According to the National Association of Realtors (NAR), over 10 years, a $10,000 investment in the stock market at a normal 10% market rate of return would yield of $23, 600. The same investment as a down payment on a $200,000 home at a normal appreciation rate of 5% would return nearly 5 times the stock market return, at $110,300.

Deciding on which mortgage will best suit your needs may seem daunting. However, with a deeper knowledge of the function of each product, plus the expertise of a mortgage professional, the task of choosing the right mortgage product will become easier. Then, you can really benefit from using your home as a financial tool!

Smith is a Personal Mortgage Consultant. Reach her at 202-232-2734.

Federal Housing Administration Mortgages (FHA)

WHO: First-Time Homebuyers and Low-to-Moderate Income Earners (Persons earning less than 30% of an area’s median income)

HOW IT WORKS: The Federal Government insures FHA loans so buyers with impaired credit or less cash can comfortably own their homes.

WHEN: FHA mortgages are good if you have only 3 percent of the home value for a down payment. FHA also has a rehabilitation mortgage that will allow you to find a fixer-upper and renovate it. THE POSITIVE: You do not have to have perfect credit, and can still qualify for a great interest rate.

THE NEGATIVE: In addition to paying the principal and interest, you also have to pay mortgage insurance that protects the lender against default, which can cause your monthly payments to be higher than if you chose another mortgage product.

Many people are aware of the benefits of financial products like their 401k, IRA, annuity, and stocks, but do not realize that they can also “cash” in on their home using products like the following:

Reverse Mortgages

WHO: Seniors 62 years and older

HOW IT WORKS: You can receive monthly cash payments from your existing home equity.

WHEN: Additional monthly income is desired to help pay for prescriptions and higher than expected retirement costs.

THE POSITIVE: You can reap the benefit of having loads of equity (cash) that you can use to supplement your income. As long as you live in the home, you do not have to pay the money back!

THE NEGATIVE: Interest is added to the loan balance because no payments are being made.

Home Equity Lines of Credit (HELOCs)

WHO: Homeowners with tons of equity!

HOW IT WORKS: HELOCs are second mortgages designed to use some of your equity as a line of credit.

WHEN: This mortgage is ideal for homeowners who have a great rate on

their first mortgage and want extra cash.

THE POSITIVE: You can receive a check book or credit card to draw on your line of credit. The interest on the amount used becomes your monthly payment.

THE NEGATIVE: You have two mortgage payments, and the rate on the HELOC can be significantly higher.

Even though the mortgage industry and the economy have endured some hard hits lately, the reality is that lenders are still lending, people are still buying and your dream castle is still waiting to be built or renovated. “For many home buyers, owning a home means a simple chance to own where they live,” says Ivan K. Brown, president of the Washington Real Estate Broker’s Association (WREBA), the historically-Black association of real estate professionals. “In reality, it will most likely prove to be their best investment tool,” he added.

According to the National Association of Realtors (NAR), over 10 years, a $10,000 investment in the stock market at a normal 10% market rate of return would yield of $23, 600. The same investment as a down payment on a $200,000 home at a normal appreciation rate of 5% would return nearly 5 times the stock market return, at $110,300.

Deciding on which mortgage will best suit your needs may seem daunting. However, with a deeper knowledge of the function of each product, plus the expertise of a mortgage professional, the task of choosing the right mortgage product will become easier. Then, you can really benefit from using your home as a financial tool!

Smith is a Personal Mortgage Consultant. Reach her at 202-232-2734.

Advertisers | Contact Us | Events | Links | Media Kit | Our Company | Payments Pier

Press Room | Print Cover Stories Archives | Electronic Issues and Talk Radio Archives | Writer's Guidelines